Investigating Residential Property Tax and Inflation

The property tax is the bedrock of local finances, accounting for more than 97% of total tax revenues for local governments in Canada. According to most economists, it is a good tax for many reasons: property is immovable, and property taxes are visible, economically efficient, and clearly tied to local spending.

But the property tax is unpopular and difficult to increase or reform. It is often the focal point in city council debates about budgets and finances. This unpopularity stems in part from the tax’s visibility. Most homeowners know exactly how much they pay in property taxes – they get a bill in the mail every year. In contrast, sales taxes are paid in small increments with every purchase and for those who are on wages and salaries, income tax is withheld from every paycheque, making these taxes less visible.

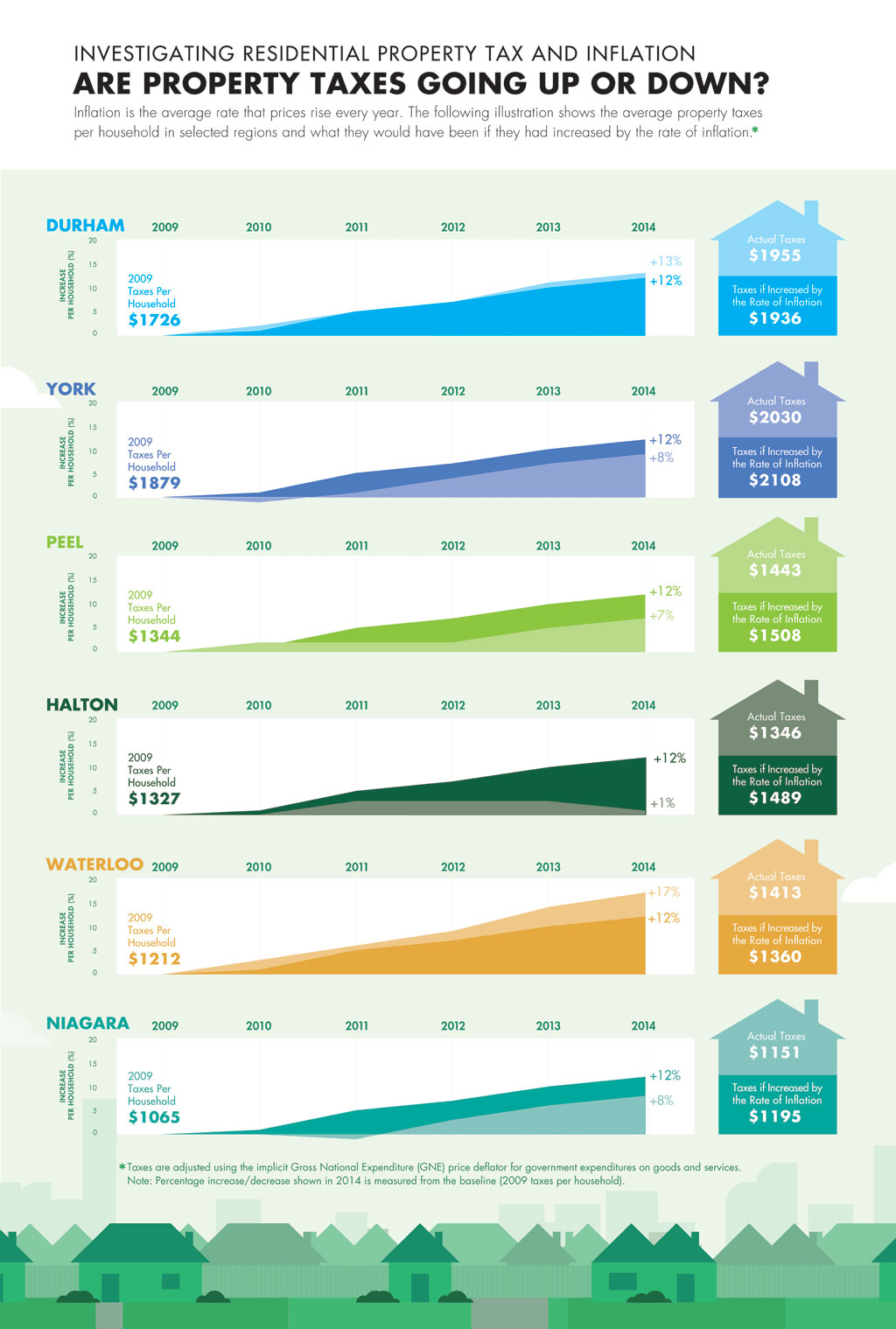

A common perception is that property taxes are rising quickly. The reality is very different. In Ontario, property taxes were lower in 2011 than in 2000 after adjusting for population and inflation.

This visualization compares property taxes paid to six regional municipalities (not including taxes paid to lower tier cities within those regions). While any number of factors can affect the amount of property tax charged in a given location (for example, provincial upload agreements), isolating these figures allows us to see how average property taxes in actual and constant dollars (adjusted for inflation) have been changing over time across Ontario’s municipalities.

Learn More

The Property Tax – in Theory and Practice

by Enid Slack, 2011

How to Reform the Property Tax: Lessons from around the World

by Enid Slack and Richard M. Bird, 2015

Can GTA Municipalities Raise Property Taxes? An Analysis of Tax Competition and Revenue Hills

by Almos Tassonyi, Richard M. Bird, and Enid Slack, 2015